#Invoice Payment

Explore tagged Tumblr posts

Text

In today’s fast-paced business environment, managing finances effectively is more critical than ever. One crucial aspect of financial management that often gets overlooked is the invoice payment process. Whether you're a freelancer, a small business owner, or part of a large enterprise, streamlining how you handle invoice payments can significantly improve cash flow, reduce errors, and strengthen relationships with clients and vendors.

0 notes

Text

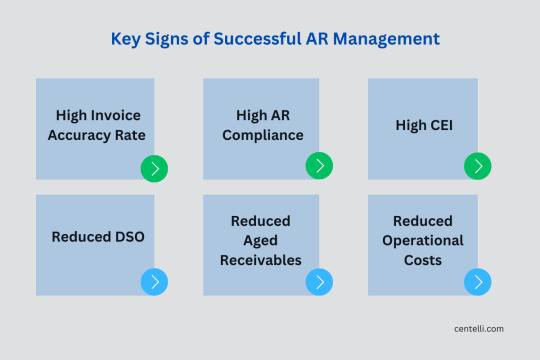

Effective Accounts Receivable Management: 15 Signs You’re on Track

Overviewing B2B Accounts Receivable Management

Accounts receivable (AR)—also known as outstanding invoices or trade receivables—is critical to your business’s cash inflow, liquidity, and operating efficiency.The AR management process itself, however, is not that simple and comprises many sub-processes spread over several phases, mostly intertwined.

Thus, each step contributes to the AR cycle, helping your collections come in faster and more seamlessly. Yet, like every other business function, your AR department can’t be flawless and efficient all the time.

Sporadic issues? That is perfectly normal!

In this article, we’ll spotlight some favourable signals that your accounts receivable operation is on track and contributing positively to your business finances.

How Effective Is Your Accounts Receivable Management: 15 Positive Signs

The positive impact of AR management reflects in a healthy cash inflow and overall business efficiency. So, while challenges are inevitable, you gain significant benefits by identifying and capitalizing on the strengths of your AR process. Also take a stock of weaknesses and address them lest they add to your bad debts and disrupt cash flow.

The following 15 positive signs indicate that your accounts receivable management is truly effective and driving your business toward financial stability.

1. Definitive Credit Policy: Beacon to AR Operations

You have a clear and well-documented credit policy in place.

The credit policy includes essential details and metrics regarding eligibility criteria, credit terms, standard practices, approval mechanisms, exceptions, review & renewal, and other relevant parameters. This mitigates credit risk and ensures consistency in credit decisions. However, a lack of clarity leads to inconsistent credit decisions, increased risk of bad debts, and customer dissatisfaction.

2. High Invoice Accuracy Rate: Key to Healthy Payment Collections

Errorless billing and seamless invoice processing!

Yes, it is important to put every essential piece of info on the invoice document, and make sure it is dispatched to customers via agreed channels on time. This allows customers to understand what they are being charged for and the payment schedule. Inaccurate or unclear invoices can cause misunderstandings, disputes, and delayed payments, however.

Simple service invoice template. Source: Microsoft.com

3. Reduced Days Sales Outstanding (DSO) i.e. Getting Paid Faster

Your DSO numbers are within an acceptable range.

A lower DSO indicates that your customers are paying their invoices promptly, improving cash flow and liquidity. Conversely, a high DSO can indicate inefficiencies in the collections process, leading to cash flow challenges and increased risk of bad debts.

Generally, businesses aim for a DSO or average collection period of 30 days or less for sales on credit. Notably, a 45-day period is acceptable for most. Furthermore, DSO levels vary across industries. For instance, in industries such as oil & gas, architectural and engineering services, and management consulting, the AR cycle can stretch beyond 60 days.

Cyclic or seasonal industries may experience fluctuations in DSO throughout the year, however.

Here is a survey that analyses Q2 2023 DSO, DPO, and DIO performance of 1,000 of the largest public companies in the United States.

4. Multiple Payment Options—Settling Invoices Faster!

Providing multiple payment options—credit card, bank transfer, or online payment systems—to your customers for invoice settlement? Convenience matters!

Offering multiple payment modes makes it easier for customers to settle their invoices faster, improving cash flow, therefore. Limited payment options, on the contrary, can lead to delays in payment processing and increased DSO as a result.

5. Fixed Billing Cycle & Proactive Receivables Tracking

You have a fixed billing cycle—monthly or bi-monthly?

Inconsistent invoices are difficult to track and follow up on, whereas a fixed cycle allows for effective tracking and timely reminders. Any lapses would mean missed opportunities to collect payments and an increased risk of aging debt. However, don’t barrage your customers with too frequent reminders!

6. Timely Account Reconciliations: Finding and Fixing AR Inaccuracies

Your accounting team diligently matches and updates accounts.

Timely reconciliation of AR accounts brings accuracy to financial records and helps spot discrepancies or errors. Delays and oversights can, however, lead to financial misstatements and difficulties in receivables tracking.

Regular account matching and timely closing are handy for audits and legal proof, furthermore.

7. High Operating Efficiency: AR Management & Execution Bearing Results

Low AR operating costs and optimized resource utilization!

Systematic and efficient accounts receivable management help streamline resources and workflows, reducing fixed and variable operating costs. This is very important because process inefficiencies—from invoicing to processing to compliance—can escalate costs at every step, thus reducing ROI and overall impact.

8. High Compliance: Elevating Accounts Receivables Management with Best Practices

Your AR transactions and records meet prevailing regulatory and industry standards.

Adhering to federal, state, and industry-specific requirements minimizes the risk of fines, penalties, and legal issues. Non-compliance can result in reputational damage, financial losses, and legal liabilities on the other hand.

9. Positive Cash Flow—AR administration Heading in Right Direction

Your cash inflows are in the green!

The state of cash flow, working capital, and expense account depends heavily on how well your company manages its accounts payables and receivables. Favourable cash inflow indicates that payments are being received in a timely manner, allowing businesses to meet their financial obligations.

It’s a sign that your accounts receivable management is impactful.

10. Reduced Aged Receivables: You’re Handling AR Skillfully

Well, AR aging percentages vary from industry to industry—10 to 15% is generally acceptable.

Minimizing aged receivables reduces the risk of non-payment and write-offs. A high volume of aged receivables can strain cash flow and increase the risk of bad debts. Most companies run aging reports monthly, quarterly, or yearly to overview theirAR performance.

11. Collection Effectiveness Index (CEI): Outstanding Receivables to Cash

Your CEI is on the higher side!

A high CEI in AR accounting indicates that the collections process is effective in converting outstanding receivables into cash. But a low CEI suggests inefficiencies in collections efforts, leading to delayed payments and cash flow problems. Accurate invoicing, clear communication with buyers, and persistent follow-ups help bolster your collection efforts.

12. Robust Monitoring & Review: Elevating AR Operations

Regular monitoring and in-depth review of accounts receivable process and performance allow businesses to identify issues and implement corrective actions promptly. Failure to monitor and review AR operation consistently can result in missed opportunities to improve accounts receivable and collections while mitigating risks.

Also, it is particularly important to filter customers who consistently delay payments. heir consistent delays pose challenges to your cash flow and liquidity management, and overall profitability.

13. AR Performance Benchmarking by Industry

This says a lot about how your overall AR administration is panning out.

14. Sound Customer Relations: Managing AR and Trade Relations Effectively

Your customers and clients pay you on time!

Issues, if any, are sorted amicably based on trustworthiness and transparency from both sides. Maintaining positive relationships with customers strengthens trust and loyalty, potentially leading to repeat business and referrals.

15. Reduced Debt Risk: Robust Accounts Receivable Management & Control

You are maintaining a low bad debt expense. Well done!

This means you are doing a good job limiting instances of overdue payments, aging receivables, and receivables that are no longer collectible. Businesses can reduce their bad debts risk considerably via effective AR management. Which of course also helps minimize the impact on cash flow.

Absolutely critical as poor management of AR and collections can increase the risk of exposure to bad debts!

Closing Note

Timely and accurate collections are the ultimate goals of accounts receivable management, whether B2B or B2C. Furthermore, achieving this with minimal operational costs and hiccups is the ‘icing on the cake’. This can be challenging, of course. Here, outsourcing provides an excellent avenue to build your AR process at a significantly lower cost than in-house operation expenses!

Get in touch with Centelli if you are seeking a competent accounting outsourcing services partner. We provide reliable, end-to-end AR accounting that fit your business needs and budget.

#Accounting Services#invoice processing services#invoice payment#Bookkeeping Services#Outsourcing Services

0 notes

Text

(A little continuation from this post about teeny tiny Steve asking Wayne for help)

“It’s not a lie!” Steve insisted, grabbing hold of Tommy’s backpack strap so they don’t get separated as they filter out of the school building. “It really happened, I swear.”

“Superman really came to your house?”

“Not Superman. Not a superhero,” Steve shook his head. “He’s just has powers. I saw them with my own eyes.”

Tommy waited until the crowd started to thin out before saying, “I think you need to get your eyes checked.”

Steve rolled his eyes, “I’m serious, Tommy. Mr Wayne could see through metal and had super-strength, and - and he can control electricity like an X-Men.”

“If he’s a superhero how come you know his name? They’re supposed to have secret identities.”

“Cause I’m smart and figured it out.”

Tommy makes a face, leading them over to the crosswalk so they can make the trek to his house, “Is this like when you went to ninja school over spring break?”

“I did go to ninja school!”

“My mom said you went to your grandma’s.”

“That’s where the ninja school is,” Steve insisted. “Grandpa Otis taught me ninja moves from the war.”

“Grandpa Otis isn’t a ninja.”

“He has a sword, Tommy. Why would he-“

“Hey, guys! Wait up!” They heard behind them and stopped as Carol ran to catch up. “Choir was cancelled. What’s up with the police here?”

“They have to be here,” Steve answered, “To help with the traffic after that girl got hit a car.”

“But why are they staring at you?”

What?

Steve turned and looked over at the cop monitoring the crosswalk. He was a big scary looking guy with a big mustache and big arms, and yeah. He was staring at them.

Steve looked away from Hopper quickly, “We didn’t do anything.”

“Maybe they know about the superhero and are looking for him,” Tommy said dramatically. “Maybe they want to capture him but they don’t know how to get to him so they’re looking at you. They know how to you easy.”

“Oh my god, he’s still talking about the superhero thing?” Carol asked.

Tommy grinned at her and the two walked off, but Steve stayed rooted to his spot. He turned back one last time, observing Hopper as he observed him. Steve frowned.

Then he ran after his friends, “Guys, wait for me.”

#Wayne working at a power plant? classic origin story#also I just love the thought of Steve being a comic book nerd as a kid and kinda growing out of it#never thinking much about it until Dustin is just wrong about something#and then he’s like: um actually…#Wayne comes home from work with a note weighed down with 72 cents#the note is a handwritten ‘invoice’ for his work and the change is his payment#the note also says B CAREFULL bc Steve’s not sure if Hopper is a superhero catcher or not#I kinda have an idea of where I’d like this to go but I’m not sure if I want to write an actual fic on ao3 or keep it in text posts on here#steve harrington#Tommy hagan#Carol Perkins#jim hopper

991 notes

·

View notes

Text

Heyo Hi I'm opening commissions up for pieces in the same style and look as my 2024 RW Artmonth interlocking triangles. These aren't first come first serve and are instead going to be selected via Google Form (Click here to fill it out) in order to make things a little bit easier on me. I will be selecting around 5 to start out but depending on how things go more could happen. Transcription of text under the cut.

RW ART MONTH STYLED PENDANT COMMISSIONS +85 USD Flat Rate +10 USD Per Notable Character +Full Color Lineless +Scene Elements Included + 900x900px +800x700px Triangle +Not First Come First Serve Upcharge only applies in case of multiple characters in focus. Does not apply to creatures or minor additions WILL DRAW: +Creatures/Monsters/Furries/Nonhumans +Especially RainWorld Themed :) +Scenes or Environment focused shots +Detailed Patterns +Expect some simplification for style WONT DRAW: -Humans or Very Human-Like -NSFW / Fetish Characters -Undesigned/Referenceless

#rain world#rainworld#uhhh ill have to think of a good new commission tag for updates and stuff#but yeah here we go :')#also payment will be done via paypal invoices i forgot to like. note that lmao

304 notes

·

View notes

Note

Hey bitches,

How long should you hold onto financial records for? I had a sorority I was part of in college send me an invoice they said I owed... from 8 years ago. Since it was 8 years ago, I have no idea whether or not that's accurate because I don't have records from that far back. I feel like they shouldn't be able to do that, but also, I can't dispute it because it's been so long, so maybe I didn't pay everything off before I left. But I don't know. I do know it makes me angry, because if I really do owe... why are they sending me an invoice now and not closer to when I actually graduated?

Um, that is ABSURD. Since they want your money, the burden of proof should be on them. Make them show you receipts! Ask for a full, itemized record of your charges and payments. I'm willing to bet they won't be able to come up with it, in which case they'll forgive the invoice.

Anyway I'm mad too. Fuck 'em!

Did we just help you out? Join our Patreon!

59 notes

·

View notes

Text

i love taking commissions bc i can just receive a paid request like anytime and ill be having returning clients commissioning me at 2am and ill be waking up and accepting said commissions and drawing them while looking like this /vpos

#miscellaneous leer#NO JOKE THO THIS HAPPENED TWICE FROM TWO DIFFERENT PEOPLE ITS SO FUNNY#im still tired but the timing is way too funny to not start drawing it#i often make sketches ahead of time before passing out so i can actually just make an invoice to receive payment afterwards#which then ill be able to communicate with clients about details as i make small tweaks before cleaning up lmao

15 notes

·

View notes

Text

Every year around this time, I'm like, next year, I'm going to finish up my part-time office job at the theatre, and live off my freelancing and creative contracts, and every year one of my freelance clients decides to try and be slick and get out of paying me and I'm reminded that what the office job offers is stability and organisational accountability, and that companies that hire freelancers for jobs they can't do absolutely love feeling like they don't owe you anything.

#i'm.......annoyed#i literally just finished at the theatre (for the year!) and was just tying up some freelance admin#and sent an email chasing the payment of an invoice from a client#and she just replied 'we pay on a fortnightly schedule and you missed the last one for 2024'#ma'am i invoiced you in OCTOBER and have been sending you weekly reminders#ugh#at least i'm having a quiet break#my car shall not be getting fixed until january now though#anyway my formal working year is done so that's good at least haha#and one of my other freelance clients has just sent through remittance so she's paid at least#positive thinking#iiiiii'mm going to have a glass of wine

11 notes

·

View notes

Text

Just a casual plug ahah

If you wanna commission me I do take them I just tend not to advertise them coz idk I’m strange. It’s always a “ask and we’ll figure it out” kinda thing.

I’ll do doodles/sketches like my previous post for $20(per character).

#artist comms#feel free to dm me for prices or a quote#havent taken a commission in a while#like they exist i just dont talk ab it#dm me!! i can make a widget on kofi or send a paypal invoice (kofi is easier since they take other forms of payment for me)#should i make an actual commissions post? yea probably. will i? no. i never like how it looks :(#or ig if u want smth cleaner like some of my orher stuff in my main tags (Kheprriverse) then just lmk and i can figure smth out#my prices used to be a lot but im not feeling like charging that much rn#(if ur coming from gw2 we can talk about gold instead)

8 notes

·

View notes

Text

Understanding Invoice Payment: A Guide for Businesses

If you’re managing a business, keeping up with invoice payments is essential for maintaining healthy cash flow. Here’s a breakdown of how invoice payments work, why they matter, and some tips to streamline the process

0 notes

Text

Skill India Mission: Objectives, Key Features, and Initiatives

The Skill India Mission is the first and foremost initiative taken by the Government of India, which is aimed at developing the capacity of the youth to become employable and entrepreneurs. Launched in 2015, this mission is about the creation and organisation of a very robust, large, and highly skilled workforce that is suitable for both domestic and international enterprises. Significantly, it attempts to empower women, the rural workforce, and marginalised communities. https://getswipe.in https://getswipe.in/blog/article/skill-india-mission-objectives-key-features-initiatives

2 notes

·

View notes

Text

.

#bruh i need to seduce one of our clients one of these days 😭 (a joke)#wdym broskies invoice reached around $97k and not even 30 mins later his accountants etransferring payment to us#and his response to the email was just ‘ok. this has been processed now’#like no shit. i saw the payment go through#king. do u need a young partner with bursts of anxiety and bouts of depression? i volunteer#sun rambles

15 notes

·

View notes

Text

Procure-to-Pay (P2P) is a process

Procure-to-Pay (P2P) is a process that manages the purchase of goods and services in a business, from requesting items to making payments. Here are the key steps involved:

Identifying Needs: Recognising the requirement for goods or services.

Requisition Approval: Approval of purchase requests by relevant authorities.

Supplier Selection: Choosing suppliers based on price, quality, and delivery time.

Purchase Order Creation: Issuing a formal order to the supplier with details.

Receiving Goods/Services: Inspecting goods upon arrival to ensure accuracy.

Invoice Matching: Verifying the supplier’s invoice against the order and receipt.

Payment Approval: Reviewing and approving the payment.

Payment Execution: Processing payment to the supplier.

Record Keeping: Storing transaction records for compliance and future reference.

P2P helps businesses control costs, improve efficiency, and maintain compliance with policies. Automation of this process, through systems like SAP or Oracle, can further streamline operations.

2 notes

·

View notes

Text

hey, regular reminder that if you get someone in your inbox (that you have never interacted with before/has never been following you) asking you to reblog a post on their blog (sob story asking for donations, usually about a pet to make it extra guilt-trippy) and they specifically ask you to answer this ask privately (for a vague and weak reason, why wouldn't they want more eyes on this post?) and then you go to their blog and their account is days old at most (and they're even claiming they have an old account that got shadowbanned ((?? being "shadowbanned" on tumblr does not mean you can't still post from that account?)) but never mention the url of that old blog) and all their reblogs are straight from the op and not from anyone they might be following who reblogged the post first (indicating they just quickly searched a semi-popular fandom tag to reblog some innocuous fanart to make the blog seem lived in)-

this is probably a scam :/ keep your eye out for odd details, inconsistency, and a glaring lack of credibility. stay safe out there everypony.

#ugh#yucky#bad taste in my mouth#this specific format of ask has also just been previously proven to be a scam tactic#so anybody trying to use it legitimately to fundraise is begging not to be taken seriously srry#they've clearly been in other peoples' inboxes with the same guilt-trippy copypasta#bc the ~200 notes they got are filled with ppl saying they cant donate rn but will signal boost it#ughhh#i'm rereading the exact wording of this post and getting so mad it doesn't make any sense#one of the pictures included is a vet invoice but they say they haven't gone to the vet yet but also the cat is pictured in a cone already#it does not make sense#said vet is also “the only one in the area that will take donations over the phone” but “needs to be paid upfront”#so. you cant have taken the cat to the vet yet. bc you dont have the money. which you are asking to be donated directly to ur paypal#thats not over the phone. thats. what?#MAYBE they mean an online payment but like.#then why do u have an invoice and the cat is clearly bandaged and in a cone already!!#then they also say the cat is already on antibiotics and only has days left if they dont get further treatment#and then a paragraph later claim the cat needs antibiotics!#im SO tempted to email this vet#i wont#im gonna put this to bed now

9 notes

·

View notes

Note

Any chance you’d ever have commissions open? And how much would they be?

I've been planning on it, main thing I'm stuck on right now is pricing. DX I don't wanna go too low because everything where I live is expensive and I dont wanna end up in a situation where I bite off more than I can chew and still can't put a dent in my expenses... But at the same time, if I go too high then nobody would be able to afford it. .n. The classic balancing act... I've been looking at what other artists I follow have price-wise to get an idea of what would be expected, though a lot of them live in places with a lower cost of living and can afford to undercharge. xnx When I take into account local minimum wage + taxes, then things start to get pricier. Though I guess that's what having cheaper options like sketches and icons are for...

Idk am i overthinking it?? I probably am, but i'm just terrified of ending up in a similar fulfillment nightmare to what doing $5 emergency bust sketches to help pay for Clarence's hip surgery was, way back when. xnx I had to pull several all-nighters to finish them all... Granted that was back when i still had 11k followers on dA, and $5 can't even buy a sandwich here, now.

Man... They really oughtta make business classes a requirement for art degrees. Maybe the 40k debt I'm in would actually be worth it then. XD ;

#also i've been told setting up on vgen is a good idea to handle the transaction stuff for me but would it be worth the extra fee?#similar thing with kofi- they also take 5% on top of the paypal/stripe/other payment fees#so idk maybe i should stick to the paypal invoices for now until i know if there's enough interest to set up something a little more solid

6 notes

·

View notes

Text

Newsflash, if an artist has super quick turnaround comms that they are doing a small opening of, they aren't interested in waiting a fucking WEEK for payment, especially when that isn't communicated until they have to chase you down to get you to pay your invoice

#i waited overnight for payment despite sending the invoice within like an hour of getting their form#and i had to go and pm them to say 'please pay your invoice' before they were like 'i cant until next week when i get paid'#WHY DID YOU COMMISSION ME THEN LMAO#why would you commission someone if you cant pay them holy shit#these are clearly done quickly in batches its such a fucking pain to have to wait just for 2 low tier icons#when i usually like to do like 5 at once

14 notes

·

View notes

Text

people who work at an office will give themselves aneurysms over literally nothing

2 notes

·

View notes